In today’s complex business landscape, choosing a reliable payment provider to ensure a seamless and secure payment process is essential for customer satisfaction, operational efficiency, and overall business growth.

However, with numerous payment gateway options available, each offering a range of features, pricing structures, and security measures, making the right choice takes a lot of time and effort.

In this article, we will delve into the key factors merchants should consider making well-thought-out decisions aligning with their unique business requirements and goals.

Why Do Merchants Look for a Payment Provider?

Some individuals starting a new business might be looking for a payment provider for the first time. Others may already have some experience with online payments, but the experience could have been better, so they decide to shop around.

However, the number of card processing companies operating on the market can be overwhelming and make the decision process challenging. Therefore, thorough preparation and in-depth analysis are crucial.

Not only do merchants need to analyze their business needs, but they also need to consider security and fraud prevention features provided by the payment gateway as well as its compliance, fees, ease of integration, overall user experience, and much more.

It might seem irrelevant, but even the location of where the company is registered may also impact the selection of payment providers a merchant can choose from. For example, this may happen when a provider doesn’t support certain security features required by law in a particular country.

Let’s get into details on how to set the boundary parameters.

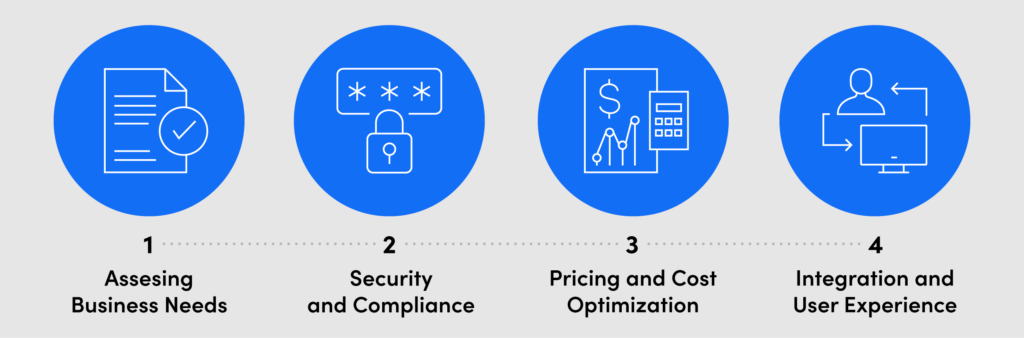

Step-by-Step Guide for Merchants

1. Assessing Business Needs

Before diving into the sea of payment providers, it is essential to understand a business’s unique payment processing requirements.

When looking for a payment gateway, merchants should consider the following factors:

- Transaction Volume and Frequency: It’s essential to determine the average number and value of transactions the business handles daily, monthly, annually, and the projected figures for upcoming years. Based on this data, assessing whether the payment provider can accommodate both current and forecasted transaction volume without compromising performance or incurring excessive costs is necessary.

- Target Market and Customer Preferences: A business’s geographic reach and the target audience’s preferences may significantly impact the final choice. The payment gateway must support the specific local payment methods most commonly used by their customers in a specific region. These should cover not only credit cards or mobile payments but also locally-specific alternative payment methods.

- Integration With Existing Systems: Evaluating the compatibility of the potential payment provider with the merchant’s existing systems is a must. The ease of integration, full API reference, or developer support to streamline the implementation process cannot be underestimated.

2. Security and Compliance

Without a doubt, payment security should be a top priority at all times for every business. And its importance grows even more when a new business partner is chosen. In these situations, you should review the following aspects:

- PCI Compliance: Ensuring the payment provider is PCI DSS compliant guarantees that the necessary security standards for processing, transmitting, and storing sensitive cardholder information have been implemented.

- Tokenization and Encryption: Tokenization replaces sensitive card data with unique tokens, thus reducing the risk of data breaches. Encryption ensures secure transmission of customer data over the internet, protecting it from unauthorized access and eliminating the risk of fraud.

Merchants should ask payment providers about data encryption, Verisign SSL certificates and CVV2 verification, and any additional encryption algorithms ensuring enhanced data protection.

- Fraud prevention: Robust, AI-based anti-fraud solutions protect businesses and their customers from unauthorized transactions and fraudulent activities, reducing the number of chargebacks.

Digital security is no longer a hot topic but an absolute must for online payments.

It is not only about the safety of the merchant account but also about the safety of their clients and payment-related sensitive information.

3. Pricing and Cost Optimization

Payment provider pricing structures and associated costs can significantly impact a business’ bottom line. Therefore, getting familiar with them before making the final decision is essential. Merchants must know in advance and, even more crucial, understand the entire fee structure.

The fee structure should be transparent and easy to understand, since there is no room for surprises or a lack of trust when money is involved.

It’s essential to ensure that no small print notes apply, especially since it still happens that some payment gateways charge additional fees for certain services, or the displayed parameters apply provided certain conditions are met, such as the minimum volume required or limited currency options.

The best advice for merchants is to ask. And then ask again, if necessary, until everything is clear.

A reliable payment provider should be able to enlist all the costs the merchant might encounter while using their service, including:

- Setup fees

- Monthly fees

- Registration fees

- Processing fees

- Transaction fees (successful and declined)

- Refund fees

- Chargeback fees

- Reserves

- Any other fees merchants may be subjected to based on different business scenarios

Careful revision of the payment provider’s terms and conditions is the only correct approach to finding a trustworthy partner.

4. Integration and User Experience

A seamless payment experience is critical to increasing customer satisfaction and maximizing conversions. Here’s what to pay attention to when evaluating payment providers:

-

- Variety of Integration Options: Payment gateways should offer various integration options to suit different businesses’ needs, including APIs, plugins, custom integrations, or even user-friendly integration solutions that can be implemented without extensive coding knowledge.

- Developer Support and Documentation: The quality and availability of support affect the comfort of business relations from the beginning.

Comprehensive documentation, including API reference guides, integration examples, and code snippets — combined with prompt and knowledgeable developer support — can significantly streamline the integration process. - Processing Options: This is where the magic happens. The payment form design is more important than it is credited with. Not only can it determine the conversion rate, but it also impacts customer confidence in the business.

Before deciding on the payment processor, merchants must check if it offers embedded card components to keep users constantly on the website (no-redirection options result in significantly higher conversion).

A frictionless checkout option will dramatically influence the user experience, simplify the entire user flow, and make payments fast and easy (a simple and perfect solution for one-time and recurring payments).

The innovative payment provider will offer a wide range of features designed to increase sales and profits such as multi-language checkout, one-click upsells, cross-sales, or “remember me” function allowing returning clients to pay with a single click. - Customization and Branding: A consistent and branded checkout experience undoubtedly reinforces trust and enhances the user experience. The ability to customize the checkout page with the logo, color scheme, and other branding elements should also be on the merchant’s must-have list. This feature set is standard practice at Shift4 since we offer our merchants easy-to-implement yet robust and flexible customization options, delivering the perfect solution for any business model. To help merchants make an informed decision, we offer a risk-free opportunity to sign up and test our amazing services for free!

- Mobile-Friendly Solutions: With the increasing use of mobile devices for online transactions, a seamless mobile experience is beyond discussion. Therefore, merchants must check if the payment processor offers responsive payment pages or mobile software development kits (SDKs) for easy integration into mobile applications

- User-Friendly Interface: The user interface (UI) of the payment provider’s dashboard or admin portal will tell all about the payment gateway’s approach toward user experience.

A user-friendly interface with intuitive navigation makes managing transactions, viewing reports, and performing other essential tasks easier. These features simplify day-to-day operations and enable merchants to monitor and analyze payment data effectively.

In addition to a user-friendly dashboard or admin portal, having a mobile app that allows merchants to navigate the dashboard on-the-go can be a significant advantage. With a mobile app, merchants can track payment activity, view transaction reports, and manage their accounts from anywhere at any time. This level of flexibility is especially important for merchants who are always on the move and need to stay on top of their payment data no matter where they are.

Check out our video below to see a more detailed overview of our user-friendly and intuitive app and how it can empower your business and help you achieve greater success. - Multi-Channel Support: Merchants whose business operates across multiple channels — such as online, in-store, and mobile — should choose a payment provider that offers seamless integration and support across all channels.

Finding a Reliable Payment Provider Pays Off

Without a doubt, selecting the right payment provider can significantly increase customer trust and satisfaction, simplify transactions, and stimulate business growth in the competitive digital landscape.

Yet, like in every business, there are some traps to avoid and things to look particularly at to ensure the quest for finding the right payment partner will pay off.

By carefully assessing specific business needs, security features, pricing schemes, integration options, and user experience offered by payment providers, merchants can choose a real business partner that seamlessly aligns with their business goals and enhances customer satisfaction.